Higher Education Is Broken: Why Kennedy Is the Best Candidate to Fix It

By Dario Calvisi, Special to The Kennedy Beacon

As The Kennedy Beacon previously reported, presidential candidate Robert F. Kennedy Jr. has more support from Millennials and Generation Z in key battleground states than his rivals do. Among the reasons to support Kennedy, young voters frequently cite his ability to “restore the hope in young people” and heal widespread Gen Z pessimism.

When it comes to higher education, young voters’ concerns about the future are well grounded. Compounding negative trends – such as the escalation of college costs, looming student debt defaults, and the deterioration of the job-market value of college degrees – are exacerbating the long-term decline in income mobility, once a cornerstone of the “American Dream.”

The student loan repayment freeze introduced during the pandemic was phased out in June 2023 and millions of students now face default. As the US Department of Education acknowledged, 40% of the 22 million borrowers failed to make October payments, which compelled the government to extend the moratorium on student loan defaults until September 2024.

Kennedy has promised to implement radical reforms to address the problems of higher-ed costs and quality. His bold proposals will reduce student liabilities by abolishing interest on new and existing student loans and by making student debt fully dischargeable in bankruptcy proceedings. Even more ambitiously, Kennedy proposes to have higher-ed institutions share the burden of student loan defaults, presently borne by lenders only, eliminating a huge incentive for colleges to charge high tuition rates. Kennedy will also confront the problem of “degree inflation,” consisting of redundant college degree requirements, by bolstering federal support of shorter-term, “micro” educational programs such as training for trades, which are still of fundamental importance in our economy.

An Increasingly Elitist and Inefficient System

The cost of higher education in the US has skyrocketed in the past two decades. Drawing on data from the National Center for Education Statistics, Melanie Hanson showed that the average cost of college “more than doubled in the 21st century, with an annual growth rate of 2% over the past 10 years.”

Consequently, student loan debt has also exploded, rising from over $959 billion in 2011 to $1.766 trillion as of the second quarter of 2023. The Federal Reserve Bank of New York estimated that student loan balances would equal $1.6 trillion in the third quarter, which makes student debt the most onerous consumer liability after mortgages, exceeding even credit card debt. These increased costs and debts have only worsened the socioeconomic gaps in higher education.

In the 2023 report “College Enrollment Disparities,” Sarah Reber and Ember Smith of the Brookings Institution noted the persistent gaps in bachelor’s degree attainment in the US, depending on “gender, race and ethnicity, and family socioeconomic status.” Reber and Smith found that enrollment gaps due to socioeconomic status (SES), “especially in four-year colleges, are enormous; 89% of students from families in the top SES quintile enroll in college compared with 51% of those in the bottom – a 38-point gap.”

According to a 2023 survey by Sallie Mae and Ipsos, 78% of families “eliminated a school from consideration based on cost.”

Adding insult to injury, many young Americans have been forced to enroll in overly expensive four-year bachelor’s degree programs to obtain jobs that did not previously require college education, such as nursing, business management, or software development. It’s the notorious problem of “degree inflation,” which Kennedy has called out for “debasing the value of education” while not improving degree holders’ job-market performance. In an in-depth 2023 report, Preston Cooper of the Foundation for Research on Equal Opportunity confirmed the sharp increase in employer-added degree requirements in recent decades, which has not reflexively translated into higher wages, noting poignantly that degree inflation “reduces the financial return on investment of a college education.”

Killing the Dream of Intergenerational Gains

The higher education crisis aggravates another distressing trend: decreasing intergenerational income mobility, a critical benchmark of economic progress that measures how closely parents’ income approximates their children’s income in the following generation. The higher the degree of income association, the lower the intergenerational mobility. Strong income mobility across generations has always been a major dimension of the American Dream.

In a recent policy brief, leading economist Bhashkar Mazumder noted that earlier estimates had strongly overstated intergenerational income mobility in the US, concluding that the US has been “actually a relatively rigid society in which income gaps were likely to persist for many generations.” These findings are consistent with the research of the Harvard-based group Opportunity Insights, cofounded by Professors Raj Chetty of Harvard, Nathaniel Hendren of MIT, and John Friedman of Brown University. In 2016, Chetty and Hendren coauthored with other experts the significantly titled paper “The Fading American Dream: Trends in Absolute Income Mobility since 1940,” which found that mobility had fallen “from approximately 90% for children born in 1940 to 50% for children born in the 1980s. Absolute income mobility has fallen across the entire income distribution.”

Scholars debate exactly which factors affect income mobility and how, but there is a strong consensus that education plays a significant role. In October 2023, leading experts confirmed in an interview with CNBC the decreased intergenerational mobility in the US, noting that education is “one of the greater openers toward greater mobility.” Economist Juan Palomino has found that “between one fifth and half of intergenerational income transmission can be explained by the level of education that parents can provide to their children.”

Kennedy Will Boldly Reform Higher Ed

On December 6, 2023, in order to deal with the looming student debt default crisis, the Biden administration approved an extra $5 billion in student loan forgiveness, even though the US Supreme Court had contentiously struck down a similar plan in June.

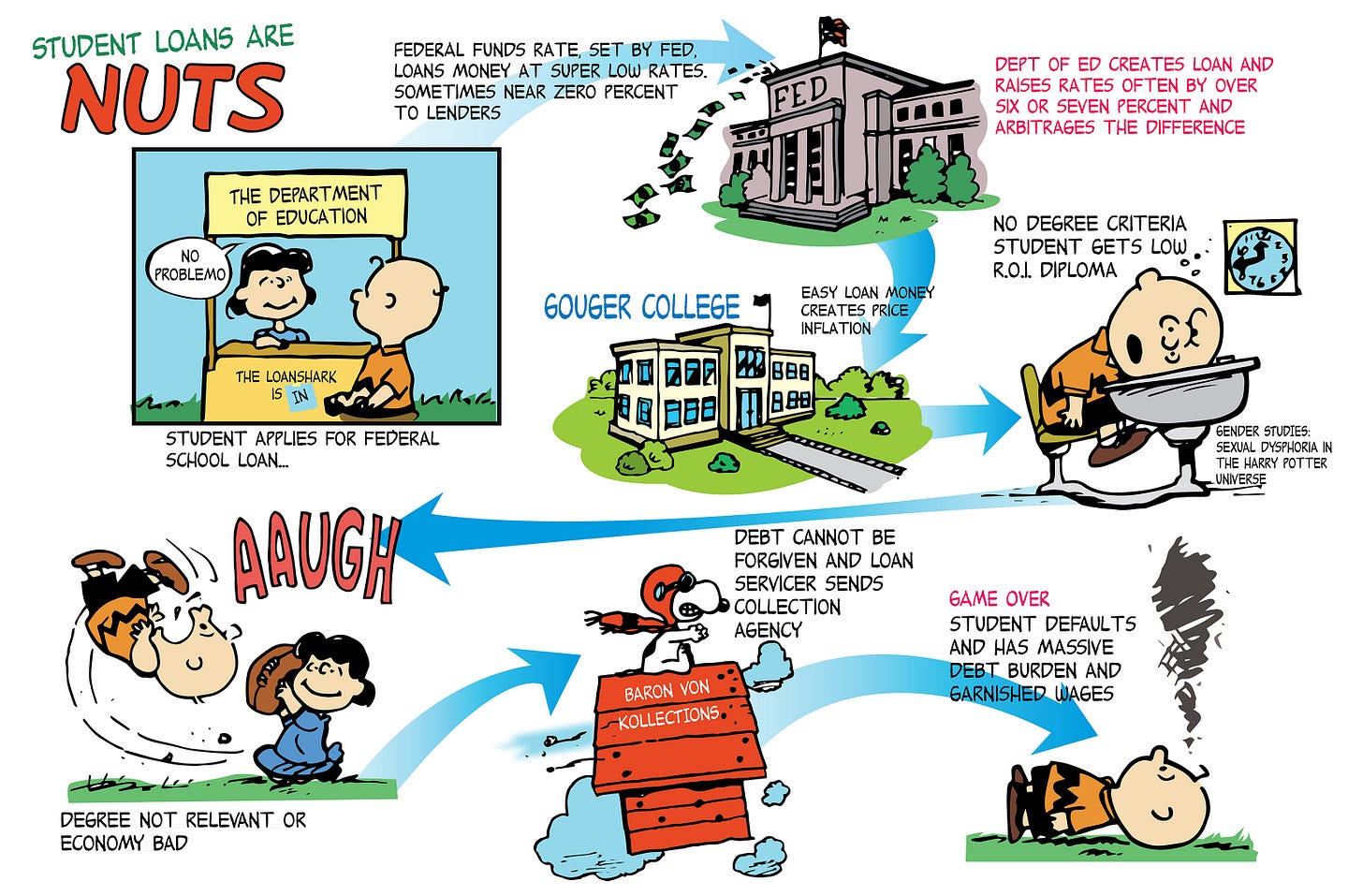

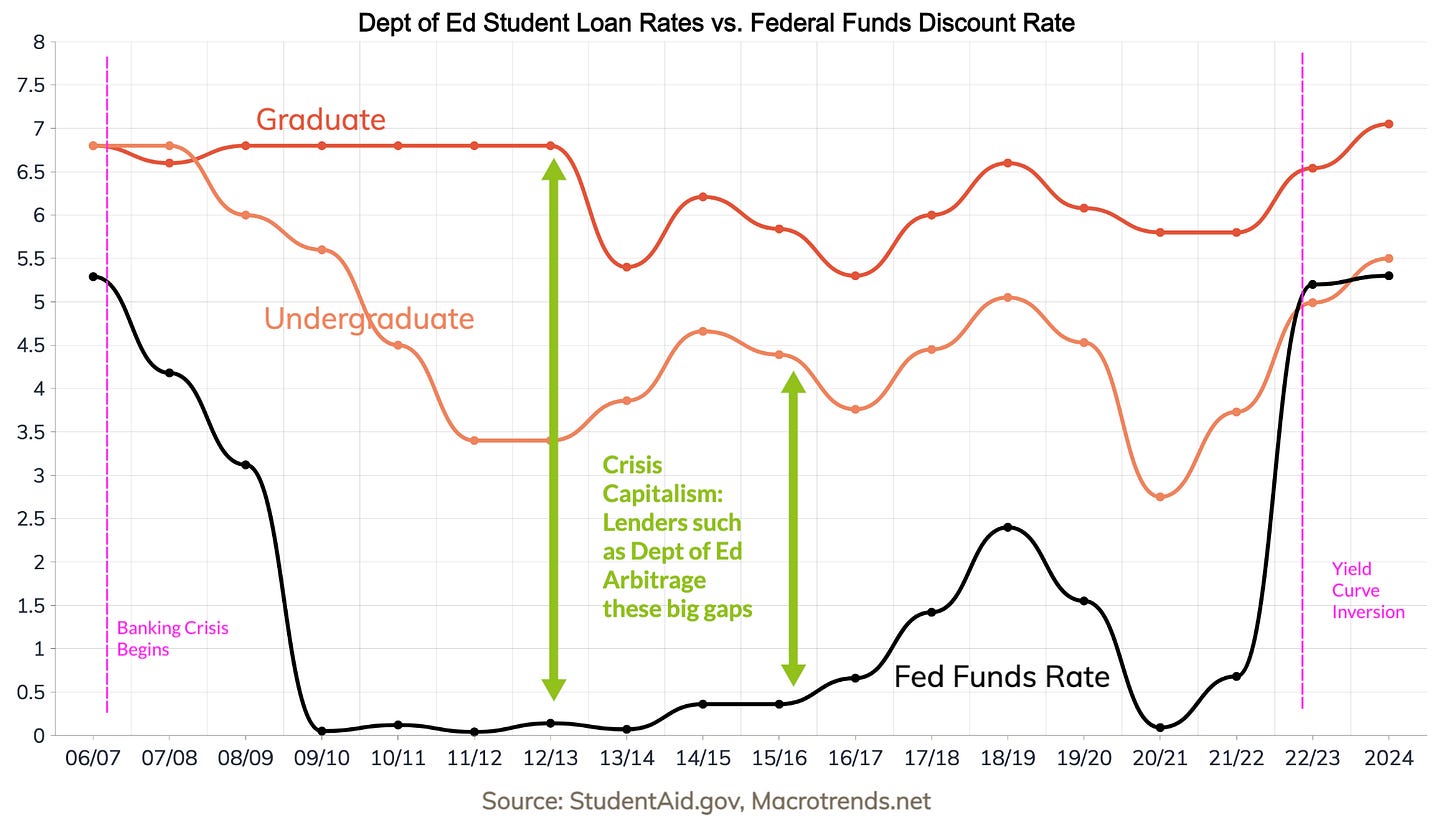

While this measure may provide temporary relief to distressed students, it does not address structural issues. Kennedy rightly argues that higher-ed institutions should share responsibility in case of student loan default, which is presently borne only by lenders and taxpayer-backed programs, because otherwise they have no incentive to keep education costs under control. In a recent opinion piece published by The Hill, scholars Arthur Herman and Alex J. Pollock endorsed this policy proposal, noting that colleges currently raise “vastly inflated tuition and fees, which they then spend without worrying about whether the [student] loans will ever be repaid. This in turn incentivizes them to push the tuition and fees, and room and board, ever higher,” in a vicious circle.

As Kennedy campaign advisor Jamel Holley explains, RFK Jr. proposes far-reaching measures to protect and contain student debt, starting with repeal of the discriminatory clauses of the Bankruptcy Abuse Prevention and Consumer Protection Act, the 2005 reform of the Bankruptcy Code, approved in 2005 with the leading support of Senator Joe Biden, which made it more difficult to discharge personal debt in bankruptcy proceedings, including student loan debt. Kennedy is committed to pushing Congress to pass legislation that would abolish interest on new and existing student loans, a measure with huge potential for immediate debt relief.

Kennedy will address the pernicious problem of degree inflation by extending adequate federal funding and student debt protection to “micro” educational programs (lasting less than two years), including training programs for trades (such as electrician, plumber, or mechanic), which are of great economic relevance, even in the looming AI economy, and are also significantly less expensive than typical four-year college degrees.

As the administration continues to squander billions of dollars to prolong the Ukraine war, neither President Biden nor Congress seems set to prioritize the crucial issue of education. In a telling episode, 19 Republican lawmakers sent President Biden a letter of protest in September 2022, fearing that his “student loan forgiveness decision [would] hurt military recruiting by devaluing GI Bill [educational] benefits.” Note the revealing implication that military recruitment can be effective only if students remain buried in debt. As reported in The Kennedy Beacon, educational benefits are a leading motivation for enlisting in the US armed forces.

Among the leading presidential candidates, Robert F. Kennedy Jr. stands out as the most serious about reforming higher education, alleviating the financial burdens of generations of Americans, and restoring fading hopes for a more equitable society. The crowds of young Americans who continue to rally in his support clearly trust that Kennedy will be up to that challenge.

I used to believe it. But how can someone, Kennedy, who is so intelligent and a deep researcher, not acknowledge the Zionist Genocide, Ethnic Cleansing, Mass Child Sacrifice and Apartheid of the Palestinians for decades? Then, he with his boyfriend Smut Merchant Shmuley, attacks Palestinians and demands US college students be censored for wanting to stop this Mass Murder and Mass Theft. Kennedy is a Snake who gives out good vibes but in reality is just one more Zionist One World Order, CIA controlled parasite.

So much for Children's Health Defense. Bomb and maim Palestinian children is fine, because my boy Shmuley the Smut Peddler says so.